Complete Guide to ESG Reporting in 2025

In recent years, the ESG regulatory landscape has been reshaped by wave after wave of new rules, and 2025 is proving to be the most disruptive yet. With new reporting thresholds and increasing pressure from banks, insurance companies, and supply chain partners, ESG reporting is no longer optional. It’s a strategic and compliance priority. Yet many companies remain in the dark - unsure which ESG report they need to file, what standards apply, or where to even begin.

That’s why we created this guide: to bring clarity to ESG reporting, break down what’s required under EU law, and show how one well-built ESG report - aligned with either ESRS or VSME - can meet your obligations and unlock long-term business value.

What Is ESG Reporting?

ESG reporting explained in plain language

ESG reporting is how a company communicates its performance on environmental, social, and governance (ESG) issues. Think of it as a structured way to answer the question: “What impact are we having on the world, and how are we managing the risks and opportunities that come with it?”

At its core, ESG reporting isn’t just about publishing data - it’s about building trust. It gives stakeholders- from investors and regulators to customers and employees - a transparent look into your sustainability strategy, your ethics, and your long-term resilience.

An ESG report typically covers:

- Environmental metrics like carbon emissions, energy use, and resource management

- Social data such as workforce diversity, human rights practices, and community engagement

- Governance topics including board structure, anti-corruption policies, and executive pay

And while an ESG report can vary in scope depending on a company’s size and obligations, the purpose is always the same: to show how your business is creating value responsibly.

Why companies should report on ESG today

With the Commission’s Recommendation, high-quality VSME-aligned data is now the gold standard for SME financing across Europe.

Growing demand for high-quality ESG data

Regulatory expectations around ESG reporting have fundamentally shifted - especially in the financial sector. With the EU’s “banking package” (CRR III and CRD VI), ESG risk is no longer a side note. It’s becoming central to how capital requirements are set, how boards are held accountable, and how supervisory authorities evaluate institutions.

Banks must now collect detailed ESG data: emissions, building energy efficiency, asset locations, exposure to high-emitting sectors, and clients’ transition plans. These data points feed into climate-adjusted cash flow projections, stress tests, and internal credit models. Without reliable ESG input, institutions are forced to rely on third-party proxies - risking governance complications and audit scrutiny.

Insurers are in the same boat. Under the updated Solvency II framework, sustainability risks must be quantified, modeled over 30-year climate scenarios, and directly integrated into solvency assessments. Weak ESG data or modeling can result in capital surcharges.

In short: high-quality ESG data is becoming as essential as financial metrics - and even more vital for long-term decision-making. Banks, insurance companies, and customers are expecting the same level of rigor and reliability from your ESG report as they do from your financial disclosures.

👉 Read more on Karomia’s blog: The Increasing Demands for High-Quality ESG Data

Market pressure and brand expectations

It’s not just regulation driving the ESG reporting wave - the market is catching up fast.

In early 2025, Febelfin and Isabel Group launched Kube ESG - a digital platform enabling Belgian banks to collect ESG data from SME clients in a standardized way. This platform aligns with the upcoming EFRAG VSME standard, ensuring banks and businesses speak the same reporting language. The implications? If you’re an SME seeking financing, you’ll need to speak it too.

In May 2025, Karomia joined forces with Isabel Group to accelerate this vision. Our partnership combines Karomia’s VSME reporting engine with Kube’s secure data infrastructure, giving SMEs a frictionless way to generate and share ESG data with banks and business partners - all in a format that’s compliant, credible, and ready for due diligence.

👉 Explore the partnership: Isabel and Karomia Partner to Simplify ESG Reporting

ESG as a driver for sustainable growth

We’re in a moment of systemic transition. Climate change, geopolitical shifts, supply chain disruptions - all these forces make sustainability not just a moral imperative, but a business-critical capability.

Modern ESG isn’t a checkbox exercise. It’s about:

- How efficiently your business uses resources

- How exposed you are to environmental or climate hazards

- How resilient your supply chain is to shocks

- How ethically and transparently you operate - from biodiversity to anti-corruption

Banks, under CRR III/CRD VI, will soon require ESG data from borrowers. Buyers under CSRD must evaluate supply chain sustainability. Employees and customers are aligning themselves with purpose-driven businesses.

If you don’t report your ESG performance, you risk losing contracts, capital, and talent.

The VSME standard offers SMEs a realistic, relevant path forward. It enables companies like yours to produce an ESG report that meets rising expectations - without unnecessary complexity or cost.

In short: ESG reporting is no longer optional. With the right framework, it becomes a strategic asset.

What Type of ESG Report Does Your Company Need to Do?

For many EU businesses, “doing an ESG report” feels like a vague requirement. But in reality, not all ESG reports are created equal - and choosing the right framework depends on your size, status, and sustainability ambition.

This section helps you navigate that choice clearly: whether your company must follow the CSRD with its ESRS standards, or can adopt the VSME voluntary framework. Either way, a Double Materiality Assessment (DMA) is the compass guiding your reporting strategy.

CSRD + ESRS - Mandatory for larger companies

If you’re a large company operating in the EU, ESG reporting is mandatory under the Corporate Sustainability Reporting Directive (CSRD). This directive, enhanced by the 2025 Omnibus proposal, defines new thresholds and a phased timeline that gives businesses more time to prepare.

Note: In February 2025, the European Commission proposed several changes to the CSRD to simplify reporting requirements. These changes are currently pending approval.

Who must comply?

Your company falls under CSRD if it meets at least two of the following criteria:

- More than 1,000 employees

- Annual revenue over €50 million

- Total assets above €25 million

Non-EU companies must also report if they generate over €450 million in annual EU revenue.

What do you need to report?

CSRD reports must align with the European Sustainability Reporting Standards (ESRS) and include:

- A Double Materiality Assessment (financial and impact perspectives)

- Detailed, verifiable ESG data across climate, social, and governance topics

- Machine-readable, tagged reporting formats (XHTML)

- Third-party assurance for accuracy

What’s the timeline?

- 2025 (FY 2024): Companies already under the Non-Financial Reporting Directive (NFRD) begin

- 2028 (FY 2027): Large companies over 250 employees or €40M turnover

- 2029 (FY 2028): Non-EU companies

- 2030 (FY 2029): Listed SMEs

👉 Learn more in Karomia’s CSRD Guide

VSME - A voluntary, simplified option for SMEs

If you’re a non-listed SME, you are not required to comply with CSRD - but you can and should report using the VSME framework.

Developed by EFRAG, the Voluntary Sustainability Reporting Standard for SMEs (VSME) offers a proportional, flexible way to report ESG - without the complexity of ESRS. It helps you meet the rising expectations of banks, buyers, and stakeholders without overburdening your operations.

Who can use VSME?

- Micro, small, and medium-sized enterprises (non-listed)

- Companies across all sectors: manufacturing, retail, services, etc.

- SMEs working with clients or suppliers subject to CSRD

What’s in a VSME report?

The VSME standard has two modules:

- Basic Module: For micro/small businesses or first-time reporters. Covers energy, waste, workforce policies, etc.

- Comprehensive Module: For medium-sized firms or those working with banks and corporates. Adds climate risk, value chain sustainability, and Scope 3 emissions.

You choose the module that matches your capacity and context, and report only on relevant topics. According to EFRAG, the VSME’s comprehensive module includes the maximum amount of ESG data that will be demanded from your stakeholders.

Latest regulatory boost (July 2025):

- VSME is now the officially recommended framework for SMEs with < 250 employees.

- EFRAG’s Basic (11 disclosures) / Comprehensive (20 disclosures total) module design keeps workloads proportionate while satisfying bank and buyer demands.

- Digital Excel/XBRL package enables one-click, machine-readable reporting.

Why use VSME, even if it’s not mandatory?

- Stay in supply chains (your clients may need your ESG data)

The Commission explicitly calls on corporates to recognize VSME KPIs, reducing questionnaire fatigue for suppliers.

- Respond to finance requests from ESG-aware banks

- Boost internal sustainability performance

- Build brand trust with transparency

- Prepare for future regulatory changes

👉 Get started with Karomia’s VSME Reporting Guide

How Double Materiality shapes the right reporting path

Whether you’re under CSRD or opting for VSME, a Double Materiality Assessment (DMA) is how you define what truly matters.

What is Double Materiality?

DMA combines two views:

- Impact Materiality: How your activities affect the environment and society

- Financial Materiality: How ESG risks and opportunities affect your business performance

Both are required under CSRD, but even if you’re not legally obligated, conducting a DMA helps you:

- Focus on the right ESG topics

- Align your reporting with stakeholder expectations

- Strengthen your strategy and business model

- Build a credible, forward-looking ESG narrative

👉 Explore our Double Materiality Assessment Guide

ESG reporting in the EU doesn’t mean every company must file a full CSRD report. But it does mean that every company needs a clear, credible ESG story - backed by the right data and aligned with the right framework.

What Should Be in an ESG Report?

The main components of a high-quality ESG report

A great ESG report goes beyond marketing claims. It delivers meaningful, measurable insight into how your company manages its environmental, social, and governance responsibilities.

Here’s how the core elements break down:

Environmental (E):

This section of your ESG report covers the company’s impact on the planet - and how it manages environmental risks and opportunities. Standard sustainability indicators include:

- Greenhouse gas emissions (Scope 1, 2, and where possible, Scope 3)

- Energy consumption and energy efficiency measures

- Waste generation, recycling, and circularity efforts

- Water usage, resource depletion, and biodiversity impacts

These are essential for stakeholders assessing your carbon footprint and climate resilience - and often required in non-financial reporting under EU regulations.

Social (S):

Social data reflects how your company treats people - both internally and across your value chain. This part of the ESG report often includes:

- Workforce demographics and diversity metrics

- Health, safety, and well-being of employees

- Labor practices and fair wages across suppliers

- Human rights safeguards and community engagement

With increasing scrutiny on supply chain ethics, social reporting is a key driver of trust and procurement eligibility.

Governance (G):

The governance section evaluates how your company is run - and whether it’s equipped to navigate complexity and mitigate risk. A high-quality ESG report typically covers:

- Board structure and executive compensation

- Anti-corruption measures and whistleblower protections

- ESG-related risk management and decision-making processes

- Tax transparency and stakeholder engagement mechanisms

Together, these three pillars form a complete picture of your sustainability performance, and how you’re building long-term value responsibly.

Data sources and KPIs to include

If you’re wondering how to write an ESG report that holds up under scrutiny, the answer lies in your data. Strong ESG reports are built on a foundation of traceable, verifiable inputs - not just good intentions.

Here are the most common sources of ESG data:

- Internal policies and audits (e.g., DEI policies, anti-bribery frameworks)

- HR data (e.g., gender balance, employee turnover, training hours)

- Financial records and invoices (for Scope 3 emissions estimation)

- Utility bills and meter data (for Scope 1 and 2 emissions)

- Procurement records (for supplier sustainability performance)

- Enterprise software outputs (e.g., ERP, ESG platforms)

And here are the most referenced key performance indicators (KPIs) in ESG reports:

- Scope 1 emissions: Direct emissions from owned or controlled sources

- Scope 2 emissions: Indirect emissions from purchased electricity and heat

- Scope 3 emissions: Indirect emissions across your supply and value chains

- Energy intensity: Energy consumption per unit of output or revenue

- Diversity ratios: Share of women, minorities, and underrepresented groups in leadership

- Ethics violations: Reported incidents, investigations, and resolutions

- Training and upskilling: Hours of ESG-related education provided

Effective ESG reporting also includes a materiality assessment - a structured way to determine which topics matter most to your stakeholders and your business model. Materiality ensures your ESG report is focused, relevant, and credible.

ESG Reporting Challenges (and How to Overcome Them)

Challenge 1: Lack of ESG data

Use what you already have

Many companies underestimate the ESG data they already hold. With Karomia’s VSME reporting solution, you can turn your existing records into a high-quality ESG report:

- Invoices

- Utility bills

- HR policies

- Sustainability memos

- Internal audits and supplier docs

Karomia automatically extracts relevant information from your uploaded documents and fills your report based on recognized ESG disclosure standards. You likely already have more data than you thin

Fill in the gaps - without the extra step

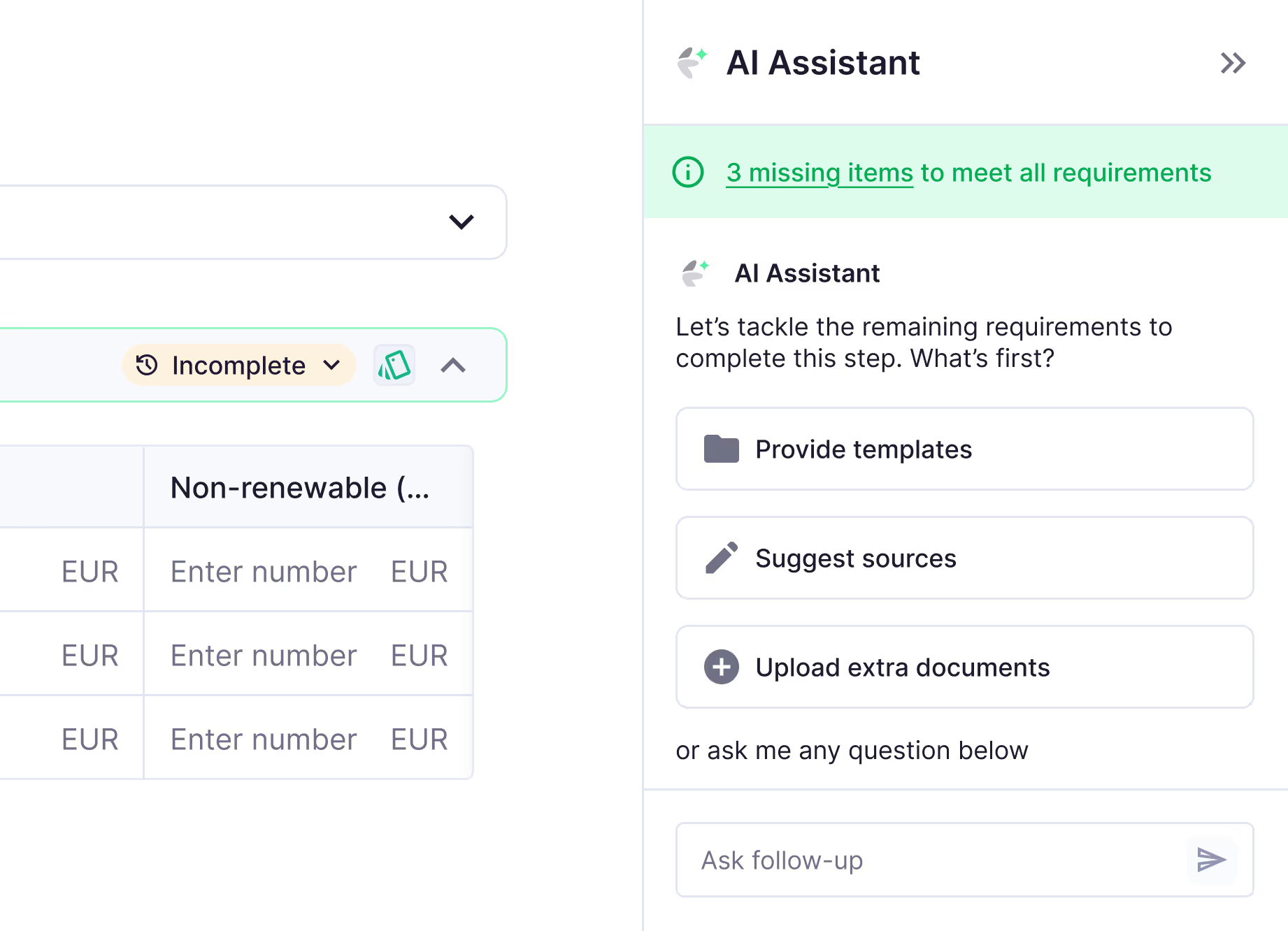

For companies reporting under CSRD, Karomia’s AI delivers an integrated Gap Assessment - seamlessly baked into the reporting workflow.

Here’s how it works:

- Upload your data - Karomia’s AI begins generating compliant draft disclosures.

- Any missing or incomplete information is flagged automatically.

- You can complete missing fields by adding more documents or use the AI assistant to generate disclosures, suggest sources, or provide templates.

- Once reviewed, mark each disclosure as ‘Complete’ and finalize it with a ‘Validated’ status.

No spreadsheet juggling. No extra tools. Just a smart, guided workflow tailored for real ESG professionals.

Challenge 2: Complex company structures

Should you report ESG at the consolidated group level, or per entity?

Before the Omnibus updates, consolidation was the norm: one group, one big ESG report. But that’s no longer always the right, or necessary, approach.

Here’s what’s changed:

- Banks and investors want ESG risk assessments where the business or financing actually happens.

- Stakeholders demand specific, relevant data.

- Post-Omnibus, many groups are no longer legally required to consolidate for CSRD.

Karomia gives you the flexibility to generate reports at entity level or group level, so you can:

- Report where operations take place

- Report where financing is secured

- Report where sustainability impact is most visible

Stick to group-level reporting only if:

- CSRD explicitly requires it

- Your investors or stakeholders request it

- You’re communicating top-down, from holding to public

Otherwise, entity-level ESG reporting is the smart move, and Karomia makes it easy to scale.

👉 Read more about this topic in our recent blog: A consolidated ESG report or on entity-level?

Challenge 3: Resource constraints

No ESG team? No problem.

Maybe your company has just set up its ESG function. Or maybe you’re wearing multiple hats. Either way, Karomia’s ESG reporting software is built for busy teams with limited capacity.

You don’t need to be an expert - just upload your documents.

- Karomia automatically defines your reporting scope based on your business model and sector

- It fills your VSME disclosures using internal uploads and external data sources

- You don’t go line by line - you focus only on what’s missing

- The built-in AI assistant walks you through next steps, suggests phrasing, and identifies appropriate data sources

Why Karomia > manual templates

EFRAG’s new VSME Digital Template was a step forward. But even with the template, ESG professionals still need to:

- Locate and extract data line by line

- Manually interpret ESG terms and thresholds

- Constantly cross-reference evolving guidance

Karomia automates all of that.

By comparison, our platform:

- Handles data collection and structuring

- Flags issues in real time

- Offers a guided experience tailored to CSRD or VSME

- Saves you weeks - if not months - of manual effort

It’s ESG reporting made intelligent, intuitive, and efficient.

One ESG Report, Done Right, Is All You Need

So how can companies keep up with the growing demand for high-quality, consistent ESG data - without drowning in duplicate disclosures and shifting standards?

The answer lies in simplification and standardization.

At Karomia, we believe that one ESG report, done well, should be enough. Whether you’re reporting under ESRS (via CSRD) or VSME, you don’t need different reports for different stakeholders. You need a single, verifiable ESG report that’s built for reuse - across banks, investors, clients, and regulators.

- Choose the right path: ESRS for larger companies, VSME for SMEs

- Report once, using a standard that’s credible, structured, and easy to share

- Use automation to surface the data you already have, and fill in what’s missing

- Avoid fragmented disclosures, reduce bureaucracy, and increase impact

This is how you make ESG reporting practical and powerful - not a box-ticking exercise, but a strategic business asset.

Frequently Asked Questions

What is an ESG report?

An ESG report is a structured disclosure that outlines a company’s performance on environmental, social, and governance (ESG) criteria. It includes metrics such as carbon emissions, workforce diversity, and governance practices, and is used by stakeholders to evaluate a company’s sustainability and risk profile.

Who has to do ESG reporting?

In the EU, ESG reporting is mandatory for companies that meet the CSRD thresholds. SMEs are not required to report under CSRD but are encouraged to adopt the voluntary VSME standard, especially if they supply to larger companies or seek ESG-conscious financing.

Does the European Commission recognize VSME?

Yes. In July 2025 the Commission issued a formal Recommendation endorsing VSME and encouraging financial institutions and large companies to use its KPIs.

What are the pillars of ESG reporting?

The three pillars of ESG reporting are:

- Environmental: Emissions, energy use, waste, resource impact

- Social: Labor practices, diversity, community relations

- Governance: Board structure, transparency, ethics

What are the key ESG reporting standards?

Key ESG reporting frameworks include:

- ESRS (under the EU CSRD)

- VSME (for non-listed EU SMEs)

- Global frameworks like GRI, SASB, and TCFD may also be used depending on geography and investor expectations.

What are the KPIs for ESG reporting?

Common ESG key performance indicators (KPIs) include:

- Scope 1, 2, 3 greenhouse gas emissions

- Energy and water intensity

- Diversity ratios (e.g., women in leadership)

- Ethics violations reported and resolved

- Training hours on ESG topics